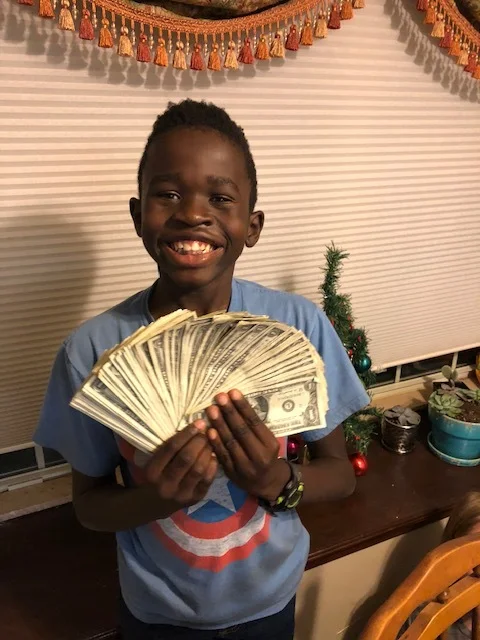

FIREKIDS: The Big Deposit

So, Zeke and Myka maxed out their retirement boxes! What an amazing feeling when the slow process of adding a small $100 stack of ones a week turns into a gigantic box full! We went to the bank and set the kiddos up with accounts and then funded them with $2,000 each! One of the tellers (not pictured) was annoyed because these kids had more in their bank accounts than she did!

It’s never to late to FIRE my friend! Living on 50% of your income takes a lifestyle change, but it is far from impossible and the results are incredible. Don’t Want to do it. Do it! The FIRE movement is not for the weak, but the payoff is…to quote one of the most inspirational poets of our generation, Mr MC Hammer himself, its “2 Legit 2 Quit!

But I digress. Back to the big deposit we go!

After the over one hour endeavor of opening their accounts… which is absolute torture for an 8 and 9 year old….and lets be honest, a 34 year old… they were officially making money on their money. Welcome to the big leagues kids. The words compound interest may not mean anything to them now, oh but it will. It will indeed.

We will be soon opening up either a brokered account or a Roth IRA for them where their money will enter the stock market. Myka and Zeke will get to talk to a financial advisor soon to figure out the right game plan for their retirement accounts. You have to believe they are suuuuper jazzed to go to that meeting! LOL, maybe their dear old Dad will have to be their delegate.

Imagine, everyone talks about how much more beneficial it is to fund your retirement in your twenties because it gives you more years to multiply. Imagine if you started in your single digits!

Just for fun, I ran over to bankrate.com to use one of their Roth IRA calculator. If the Roth is funded $5,200 a year ($100 a week x 52 weeks) and has a expected rate of return of 7% each child would be projected to have over $3.7 Million dollars!!! The total amount of contributions they would put in would be $296,400 and it would be worth over 12 times what they put into it! Wow. Wow. Wow!

However, if they waited until age 28 to start funding their retirement like a normal person they would only have approx. $916k in the account. Being a FIREkid could improve their retirement 4 fold over traditional measures.

I love, love LOVE this process. I think it will change the path of finance among the masses if it is widely adopted. Playing with FIRE is so rewarding!