Welcome to FIREkids!

This is blog is meant to provide access to the journey of the Original FIREkids, Ezekiel (Zeke) and Mykayla (Myka) Bright. The journey began when I had this conversation with Zeke when he saw and wanted a really cool toy:

Zeke: Daddy, look at that toy! Its soooo cool, can I have it?

Daddy: No.

Zeke (In a whiney voice): Why! I really want it!

Daddy: Because we don’t have money for that, Zeke!

Zeke: Can’t we just go to the bank and get some more?

Daddy: How does the bank account have money?

Zeke: It just does, they give it away when you come in.

I knew then that I had a problem. My kid was IGNORANT when it came to money. Not because he’s stupid, far from it. He’s very smart, the failure came from me! I had never taught him how money works! I knew I had to teach him how money works and how to use it for what it is, a tool.

That night I pondered, how do I teach my kids about money? I want them to respect it, and understand how it works, and to do that I had to develop or use a current program. I watched a bunch of YouTube videos, Ted Talks, and financial education websites. All together it helped me create my new concept, FIREkids. FIRE stands for Financial Independence and Retire Early, and is a movement to help people take control of their spending habits and teach them to use money as a tool to help them fund their future at an early age allowing them to retire early. That sounded great, but there wasn’t from what I could see a platform geared for kids.

So what I decided to do was “adult up” my kids, and give them responsibility. Instead of doing the chores because Mommy and Daddy said so, and sometimes giving them an allowance when we had the cash, we decided to run our house like a little business. The kids would chart their chore progress and submit their invoice at the end of the week to receive their “wage”. That income would be $100 at the max and then reduced by unsatisfactory performance. If they didn’t remove their clutter off the table then their wage would be docked. If they didn’t clean their bathroom or feed the pet, their wage would be docked. They soon realized to get that awesome feeling of getting a full $100, they had to perform their tasks and not be lazy.

Now instead of Daddy nagging and getting annoyed about how big of a mess everything is, the chart just doesn’t get filled in, and their pay is docked. It takes the pressure off of the parent to force the kids to do what they need to, because the chore chart is motivating them. Those kids WANT that chore chart filled in, they want that cash, so they want to do their chores!

This is Zeke and Myka with their newly acquired chore chart, they are EXCITED

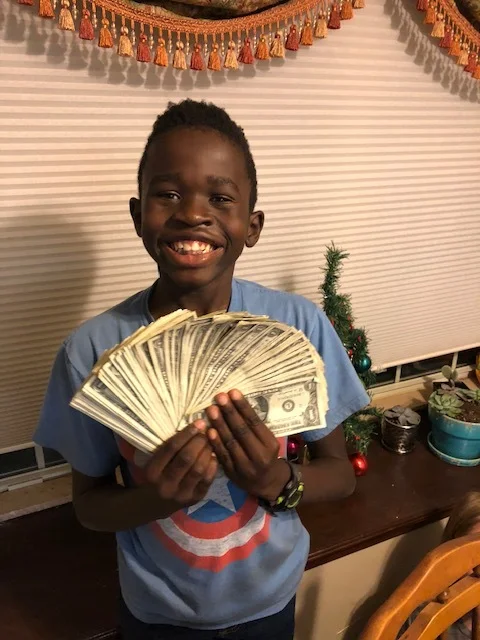

After the first week, Zeke and Myka received their first $100. Look at those faces! So pumped!

They then divided that fat stack into their respective groupings. $10 for G-D, $40 for their current needs, and $50 for their future needs. These kids are putting 50% back for their future! Imagine if you had started putting back 50% of your income before your expenses started adding up and ate up your wage! Where would you be now? How would your life be different today? That’s what we are trying to instill through FIREkids, giving them the knowledge to control their finances before their finances control them. Teach them financial independence before they experience financial DEPENDENDCE.

Stay tuned with FIREkids, see the progress and use the message boards to describe your processes and progress! We are in this together team, we can teach our kids how to use money. They aren’t going to learn it in school, we have to teach them at home.